Morning Note

- Revenues down 3% in Q2

- Management very active to set up new growth drivers

- Time has come to play the rebound: upgraded to BUY

Counter performance in the US, stability in the ROW

SpineGuard posted last Thursday Q2 revenues of EUR1.80m (vs EUR1.86m in Q2 2018), down -3%. Currency impact is limited compared to Q1 (-6% on a like-for-like basis). 1,850 DSG units (all references included) were sold in Q2 (1,200 in the US and 650 in the rest of the world) to be compared to 2,001 in Q2 2018. Average Selling Price in Q2 is roughly stable in the US (EUR1,252 vs EUR1,293 in Q1), globally in line with the average prices posted over the three last years (1,209 in 2016 – 1,256 in 2017 – 1,201 in 2018). Besides the change in the marketing strategy, the new purchase modalities in first-tier hospitals represent a real entry barrier for small actors like SpineGuard/Zavation. The current trend is to sign a limited number of supply contracts with groups owning an extended catalogue of products and devices (from equipment to implants, not restricted to orthopedics) allowing higher discounts for large volumes. This situation benefits clearly to big medtech players. Small companies with a dedicated offer might have access to these key accounts but most of their business is done with second- and mostly third-tier hospitals requiring huge commercial efforts for a lower return per account. In the rest of the world, performance in Q2 was improved in Europe and China. Middle-East, Turkey and Arabia did not deliver as expected. ASP in Q2 came at EUR452, a significant improvement compared to Q1 (EUR337). Overall, ROW was stabilized, a situation expected to be confirmed in the next quarters.

After a weak Q1, we were not expecting a strong Q2. The figures posted are 10% below our expectations (EUR2.0m).

Lionel Labourdette, PhD, MBA

lionel@biostrategic-research.com

+33 617 965 019

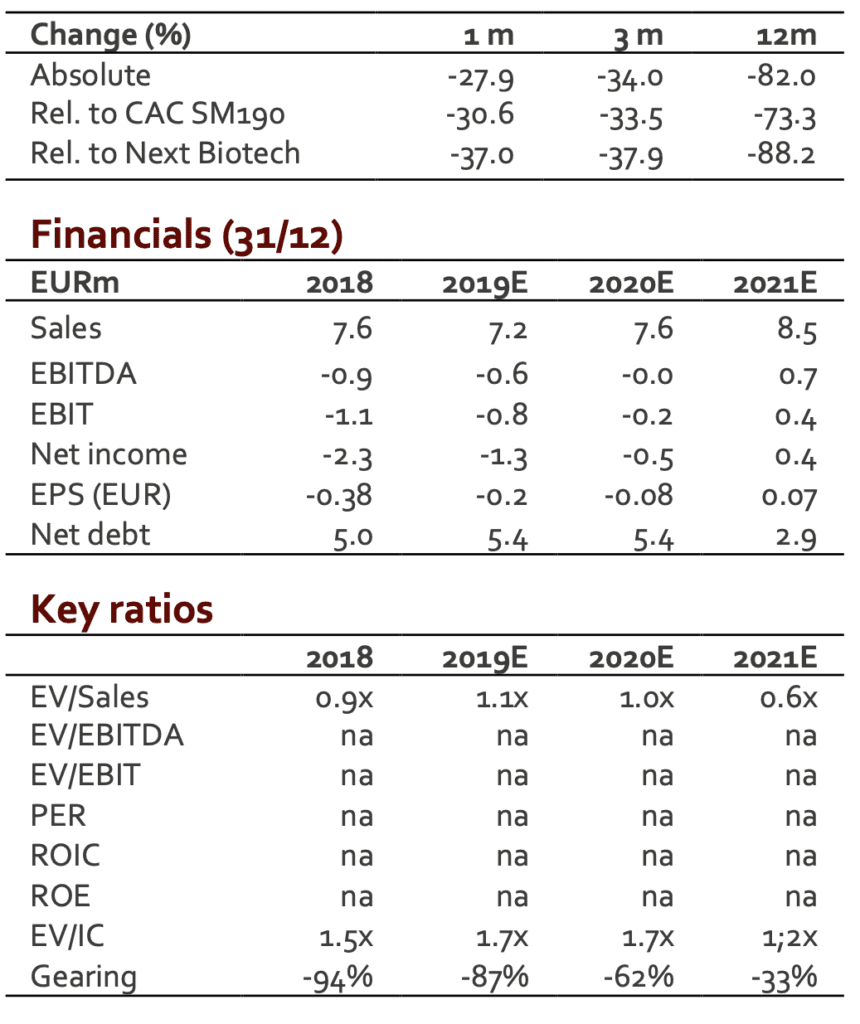

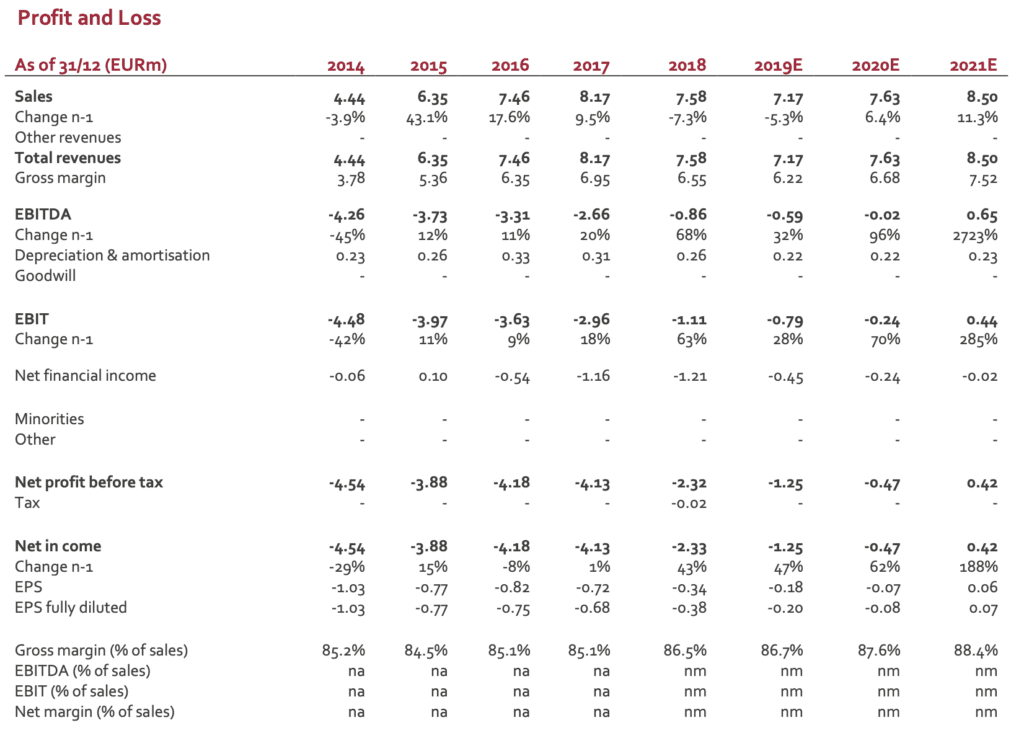

Profitability improved

After a positive Q4, SpineGuard was supposed to reach the breakeven in 2019 and to deliver a sustainable operating profitability. This scenario was however clearly dependent on the ability to expand revenues. The decline in H1 has therefore a direct impact on the P&L. A first estimate released by the group (not audited figures) sees the operating loss close to EUR0.4m (vs a loss of EUR0.8m in H1 2018). This improvement results from the new organization and from a strict cost control. H2 is expected to see improvement with the move of the US-based offices from California to Colorado (significant drop in fixed costs).

Does H1 “negative” trend means DSG story has ended?

Since the IPO in 2014, SpineGuard succeeded in demonstrating that Dynamic Surgical Guidance was a real innovation in spine surgery offering improved safety for the patient (limiting the risk of neural damage when implanting pedicle screws) and for the surgeon (lower exposure to X-ray radiation). Year after year, the group has expanded its range of devices as well as developed new devices or technologies (addressing the dental segment or robotics). In a moving environment (regulatory constraints, price pressure, new supply modalities, dominant position of large medtech players), delivering the initial equity story is today quite unfeasible. The key question to be answered mid-2019 is to identify a new and realistic value creation scenario. If not in the best situation to date (regarding the classic range of PediGuard), one must admit that SpineGuard owns solid technological assets around which the group has the opportunity to build a future.

Key achievements in 2017 and 2018

If not fully delivering expectations, the launch of the Smart Screw in the US is on course and surgeons having assessed this disruptive device express clearly their satisfaction. There is no doubt that the marketing approach has to be re-defined and we still believe this device will generate interest among medtech players, and ideally become a key reference in the catalogue of a large medtech actor. As expressed in our previous comments, future lies in strategic partnerships. In a similar way, PediGuard Threaded (dedicated to minimally invasive surgery) enters in a rising number of operating theatres, showing that spine surgeons see the benefits of DSG when placing screws with a minimal vision perimeter.

Besides a continuous improvement in the cost structure, the group has supported different innovation programs allowing to address news markets or potential partners. We identify two key projects supposed to become future growth drivers:

- The partnership signed with Adin in the dental space is an undisputed demonstration of the versatility of the DSG technology. To date, a first generation of devices was cleared (CE mark in December 2018). If revenues from this first range are likely to be limited (devices to be improved and adapted to surgeon’s needs), this represents an undisputed proof of concept and a major move in this new market. Adin is investing heavily on this key project and new devices are likely to be launched over the period 2020-2021.

- Robotics: the place to be for DSG technology. Surgery has entered over the last decade in the era of robotics. The rising offer (implying a rising demand among surgeon’s community and hospitals) represents a real opportunity for SpineGuard whose technology can make surgery more precise and safer (retro loops control for example). The technological partnership with ISIR (Sorbonne, Paris – France) led to the first successful preclinical studies in real-time guidance of robot arms.

What to expect in the next quarters?

The changing environment made the management think about addressing its markets with a different manner. A direct approach and/or through distribution contracts with (often small) local players is definitively behind us. The continuous increase of surgeries performed with PediGuard (>70,000) and/or more recently with the Smart Screw (300 successful surgeries), supported by clinical studies/publications demonstrating the benefits of DSG technology will help in the presentation to potential partners. The company is today supported by Healthios Capital Markets (a Chicago-based boutique) to create value around its assets. Ongoing process opened the door of a number of Medtech companies likely to be interested in the existing products as well as potential usages of DSG technology. Discussions and negotiations require time. Getting satisfying offers is still far away and clearly uncertain. However, there is no doubt that SpineGuard goes ahead in this direction and we expect good news in the future (commercial deals and/or licensing of DSG technology for new applications).

On the business side, SpineGuard is expected to launch soon “DSG Connect” (a connected pad adding the visual function to the previous sound signal). If not game changing, this device will consolidate the existing base of surgeons already convinced and regular users of PediGuard. Lastly (but not least), Adin is expected to generate increasing revenues from the first devices sold in the dental indications. Most important is the energy put by the partner to take the lead in the dental market: R&D team works hard to develop new generation of DSG-based devices compatibles with existing electric devices such as drills (from any supplier). We do not identify technological hurdles that might postpone the ongoing development programs. If not fully warranty, we do not see critical regulatory concerns.

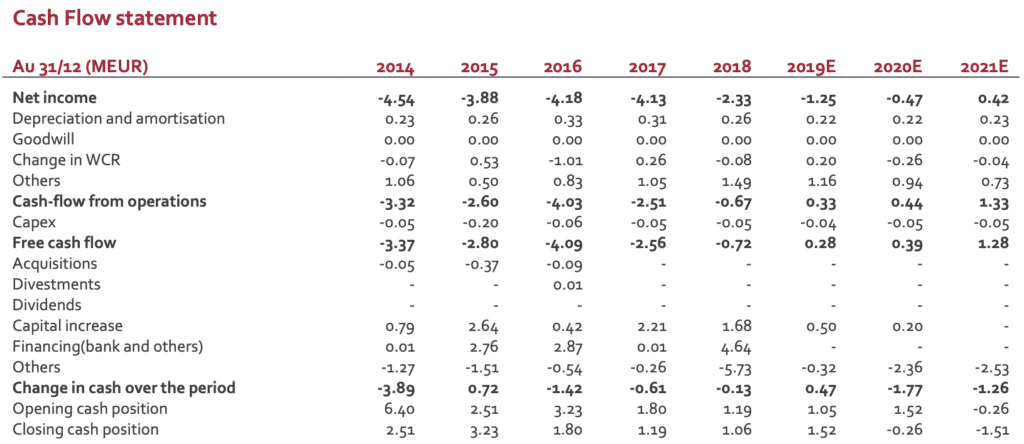

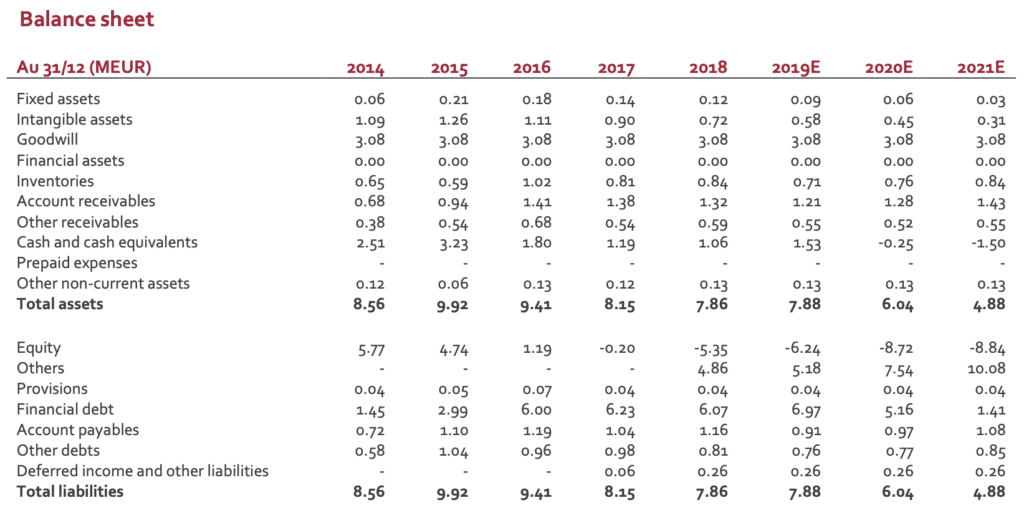

Cash position: remains a real concern

The new organisation and a tight cost control have limited the burn rate in H1 but the lack of significant growth of revenues has a direct impact financial visibility. The group has secured convertible bond facility (visibility until April 2020 according to management’ guidance). New financing is therefore required. If a deal scenario is likely, the group does not have any visibility on the timing. This uncertainty is expected to keep a pressure on the stock.

Valuation and rating: from HOLD to BUY

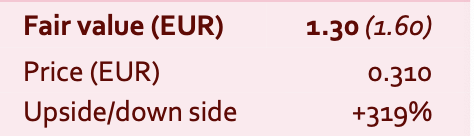

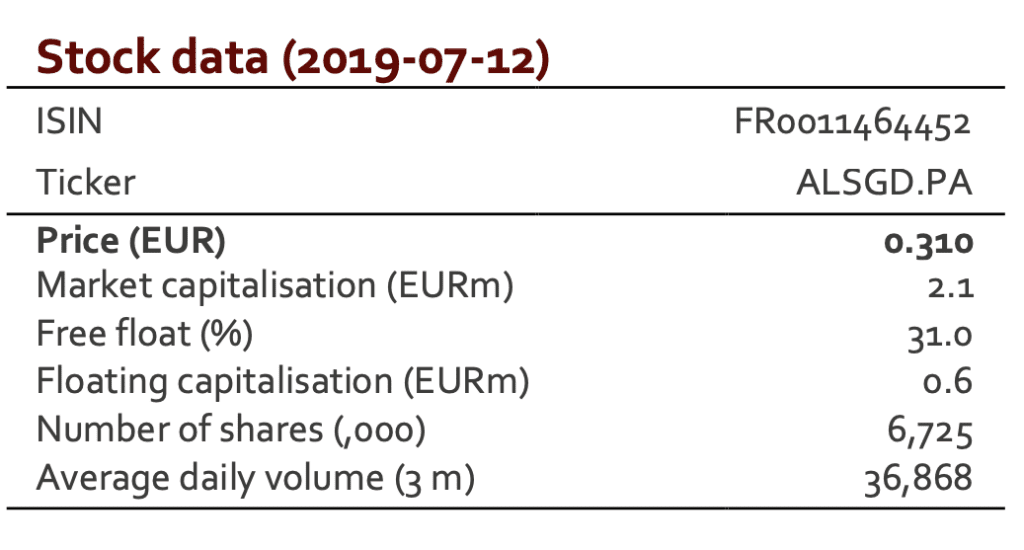

The figures posted are 10% under our revenue scenario for H1. We do not have any strong signal for H2 that could support our current FY estimate (EUR7.6m). We have therefore adjusted our model for 2019E. Regarding 2020E and beyond, the future revenues will depend on nature and size of the deals likely to be signed. To date, it is quite impossible to have a realistic model. We have therefore maintained our previous scenario to which a 10% discount was applied. According to these new figures, our new DCF valuation comes to EUR1.3/share (from EUR1.6/share).

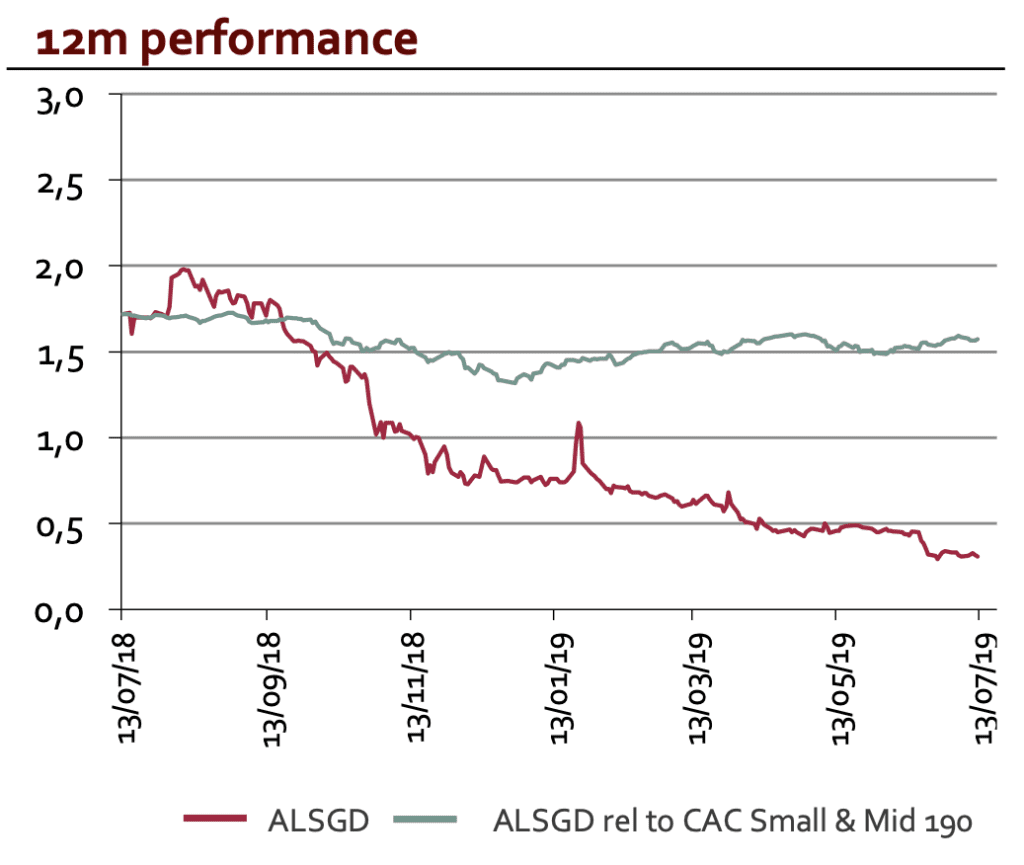

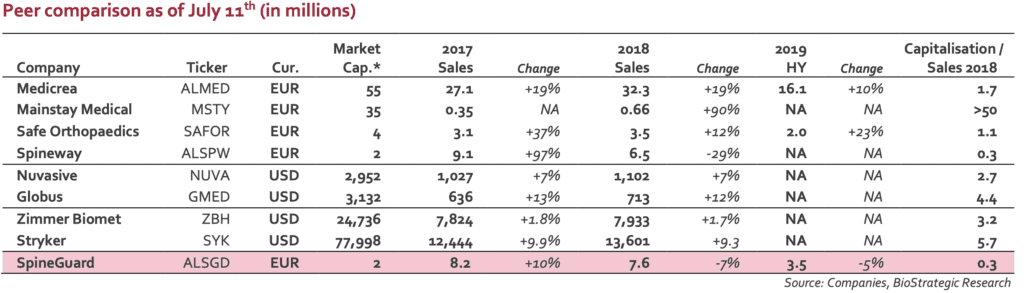

Stock price is definitively disconnected from the value of group’ assets. With a EUR2m market capitalisation, the valuation is significantly below sector peers. The following table gives a rapid overview of what the market pays for small players in the spine market (Euronext listed companies as well as US based actors and large medtech companies).

Whatever the financial situation, DSG technology has a real potential (if not in direct spine indication, robotics is a real opportunity). When looking at the balance sheet and according to an estimate net debt of EUR5m, the ratio EV/sales 2019E is close to 1.0, a figure clearly disconnected from the industry average (3 to 4x or more). The current stock price makes a M&A scenario more and more realistic. Any

investor will admit that DSG represents a technological brick that is more than EUR2m worth… Investors have to keep in mind the French Medtech’ takeover in 2016 by Zimmer Biomet for 164EURm (Medtech was developer of the Rosa Robot, dedicated to brain and spine surgery).

The dossier remains complex and financial visibility a real concern. That said, we see the management today focused on finding ways to create value around the assets. Ongoing process to find partners is clear, organized and we are confident in future deals. When looking at the market capitalization, peers, and the likelihood of deals, we consider that SpineGuard represents a real opportunity for investors willing to bet on the robotics wave and/or on recovery scenarios. Defining a fair value is very complex (depends on the value a potential partner is willing to create). Our DCF valuation represents a kind of conservative benchmark but clearly underestimates any leverage made by a buyer or licensee.

We upgrade therefore our recommendation from HOLD to BUY and adjust our target price to EUR1.3 (from EUR1.6).

Next publication: HY results, 18th, September 2019 (after market)

IMPORTANT INFORMATION

Responsibility for this publication

This publication has been prepared under the only responsibility of BioStrategic Partners.

Recipient

This publication is exclusively designed for “Eligible Counterparties” or “Business Customers”. It is not designed to be distributed or transmitted. directly or indirectly. to “Retail Customers”.

Absence of investment advice

This publication has been produced for information only and does not represent investment advice. given that it has been prepared without knowledge of the financial situation. asset position or any other personal circumstance of the persons who may receive it.

Absence of buy or sell offering of financial instruments

This publication does not represent an offering or an incentive to buy or sell the financial instruments outlined in it.

Reliability of information

Every precaution has been taken by Biostrategic Partners to ensure that the information contained in this publication come from sources considered reliable. Unless otherwise specifically indicated in this publication. all opinions. estimations and forecasts given. are those of Biostrategic Partners at that date and may be revised without prior notice.

Exemption from liability

Neither Biostrategic Partners nor SwissLife Banque Privée shall be liable for any damage that may result from the incorrect or incomplete nature of this publication. Neither Biostrategic Partners or SwissLife Banque Privée is not liable for any investment decisions. regardless of their nature. made by the users of this publication on its basis.

Transfer and distribution of this publication

This document was sent. prior to its publication. to the issuer of the financial instruments to which it refers. This document may not be reproduced. distributed or published in whole or in part without the prior written consent of Biostrategic Partners and SwissLife Banque Privée.

Warning concerning performance

Investors should note that any income from financial instruments can fluctuate and that prices can fall as well as rise. Past and simulated performance does not guarantee future performance.

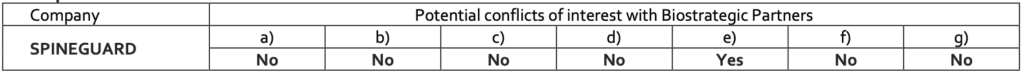

Detection of potential conflicts of interest

a) Biostrategic Partners has participated or is participating. either as lead manager or member of an investment or guarantee syndicate for a financial transaction. either as advisor of a public offering over the last twelve months or as Listing Sponsor of the company.

b) Biostrategic Partners holds an investment stake greater than or equal to 5% in the capital of the company under analysis.

c) The company who is the subject of this analysis holds an investment stake greater than or equal to 5% in Biostrategic Partners.

d) Biostrategic Partners and/or one of its affiliates is/are liquidity provider(s) or market maker(s) for (one of) the company’s financial instrument/s.

e) Biostrategic Partners has agreed with the company to provide a service of production and distribution of analysis regarding the company.

f) Biostrategic Partners has modified its conclusions after notifying the company before its distribution of this analysis.

h) The person/s responsible for the analysis. a director or a member of the Board of Directors of Biostrategic Partners is a manager. director ormember of the Board of Directors of the company.

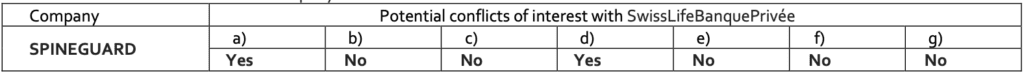

a) SwissLife Banque Privée has participated or is participating. either as lead manager or member of an investment or guarantee syndicate for a financial transaction. either as advisor of a public offering over the last twelve months or as Listing Sponsor of the company.

b) SwissLife Banque Privée holds an investment stake greater than or equal to 5% in the capital of the company under analysis.

c) The company who is the subject of this analysis holds an investment stake greater than or equal to 5% in SwissLife Banque Privée.

d) SwissLife Banque Privée and/or one of its affiliates is/are liquidity provider(s) or market maker(s) for (one of) the company’s financial instrument/s.

e) SwissLife Banque Privée has agreed with the company to provide a service of production and distribution of analysis regarding the company.

f) SwissLife Banque Privée has modified its conclusions after notifying the company before its distribution of this analysis.

g) The person/s responsible for the analysis. a director or a member of the Board of Directors of SwissLife Banque Privée is a manager. director or member of the Board of Directors of the company.

Swiss Life Banque Privée

Société Anonyme au capital de 37.092.080 €

Code établissement bancaire n°11 238

RCS Paris 382 490 001

7. place Vendôme – F 75041 Paris Cedex 01 – France

Tél. : +33 1 53 29 14 14

BioStrategic Partners SAS

Société par Actions Simplifiée au capital de 30. 000 € RCS

Paris 530 430 487

140 bis. rue de Rennes – F 75006 Paris – France

Tél. : +33 6 17 96 50 19

BioStrategic Research est une marque déposée de BioStrategic Partners SAS